vermont sales tax on alcohol

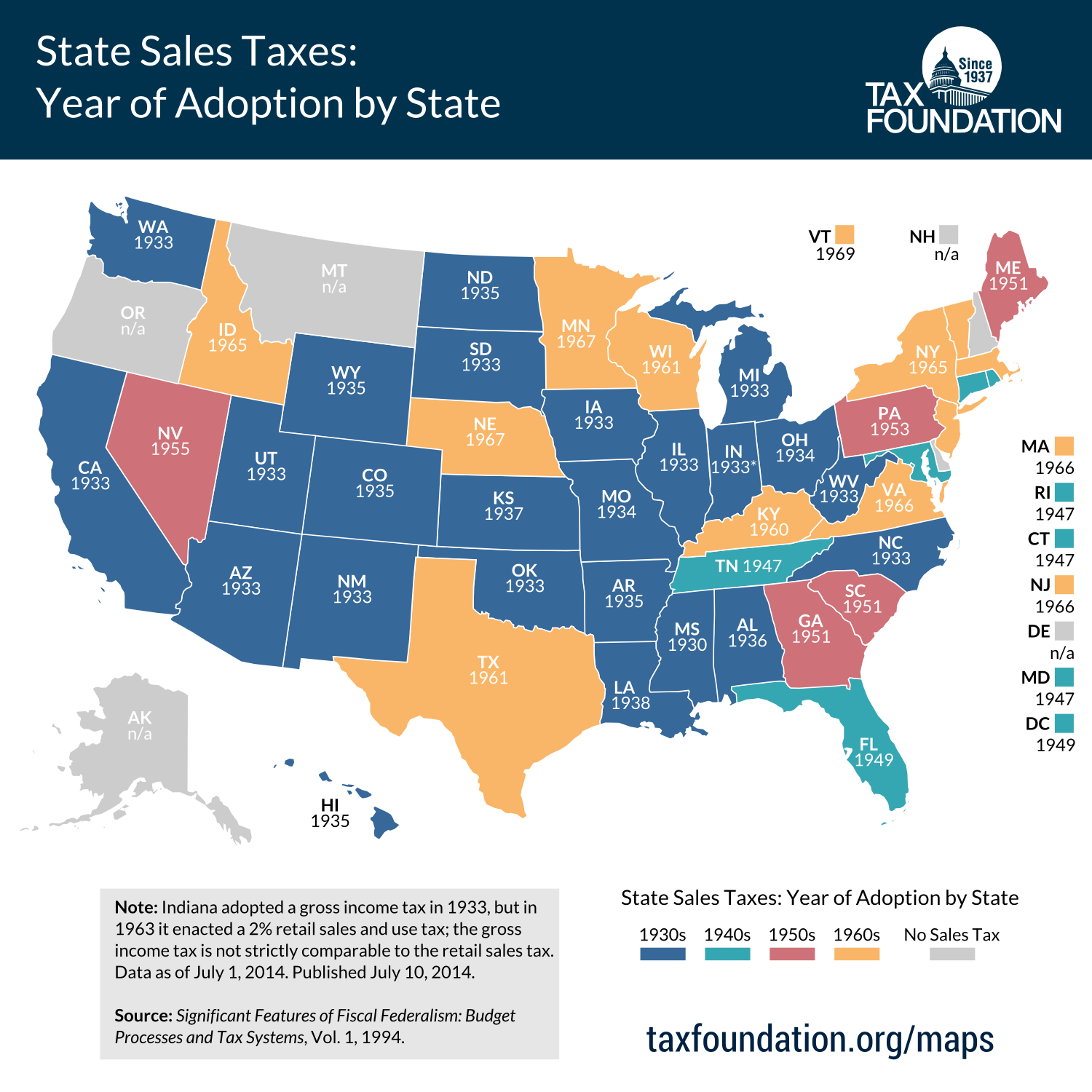

The best way to determine whether a beverage falls under the definition of a soft drink is to read the product label. Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6.

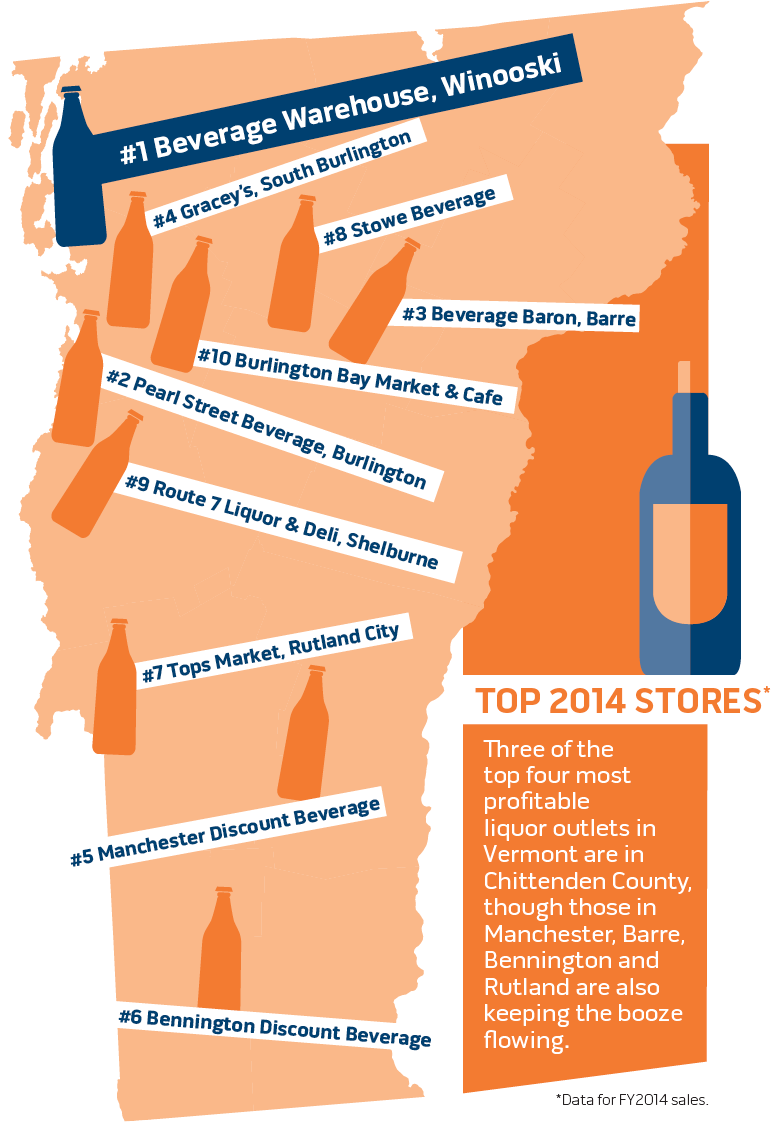

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Beer and wine are subject to Vermont sales taxes.

. Sales and Use Tax 32 VSA. Vermonts general sales tax of 6 does not apply to the purchase of liquor. Vermont has recent rate changes Fri Jan 01 2021.

With local taxes the total sales tax rate is between 6000 and 7000. W-4VT Employees Withholding Allowance Certificate. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax. Thus the sales tax on alcohol can be as high as 121. Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax.

Alcohol used to be exempt but a 6 state sales tax was added to all alcohol and liquor sales in April 2009. This means that an individual in the state of Vermont purchases school supplies and books for their children. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. Vermont sales tax on alcohol Saturday February 19 2022 Edit. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Direct Ship to Retail. The U S Liquor Supply Chain Could Take Years To Recover From Covid 19 Upheaval Npr Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice.

In Vermont this is the 3SquaresVT program. 0183 per gallon. Local sales taxes can bring the total to 7.

Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

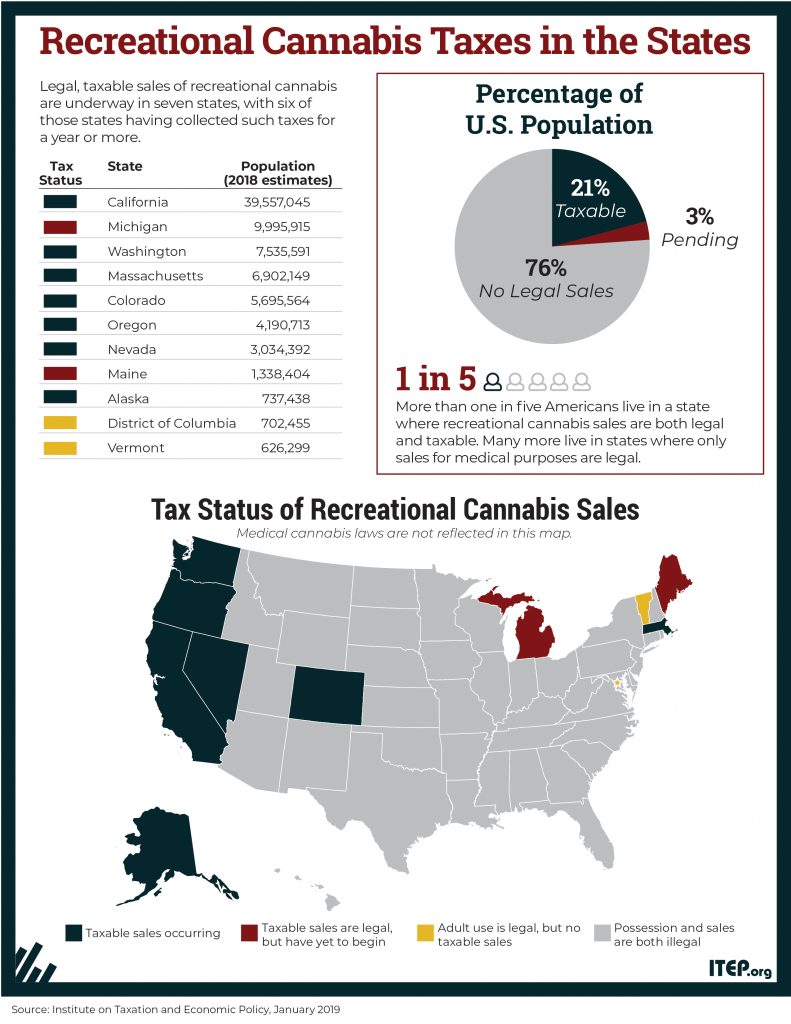

Alcoholic Beverage Sales Tax. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS.

The state of Arkanas adds an excise tax of 250 per gallon on spirits. The state sales tax rate in Vermont is 6000. The tax rate is 6.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1. There are a total of 153 local tax jurisdictions across the state collecting an average local tax of 0156. Missouri has a 4225 statewide sales tax rate but also has 731 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3667 on top of the state tax.

PA-1 Special Power of Attorney. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax.

To learn more see a full list of taxable and tax-exempt items in Vermont. Vermont sales tax reference for quick access to due dates contact info and other tax details. Alcoholic Beverage Sales Tax.

Note that in some areas items like alcohol and prepared food including restaurant meals and. Learn more about Vermont Sales and Use Tax. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected.

Average Sales Tax With Local. The tax on any alcohol. Select the Vermont city from the list of popular cities below to see its current sales tax rate.

SNAP or food stamps are exempt from sales tax. The state sales tax is 6. The tax rate is 6.

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. Effective June 1 1989. IN-111 Vermont Income Tax Return.

45 rows The sales tax rate is 6. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. For beverages sold by holders of 1st or 3rd class liquor licenses.

The tax on beer is 23 cents and on wine its 75 cents. See definition at 32 VSA. This page describes the taxability of occasional sales in Vermont including motor vehicles.

Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. Liquor sales are only permitted in state alcohol stores also called ABC Stores. Liquefied Natural Gas LNG 0243 per gallon.

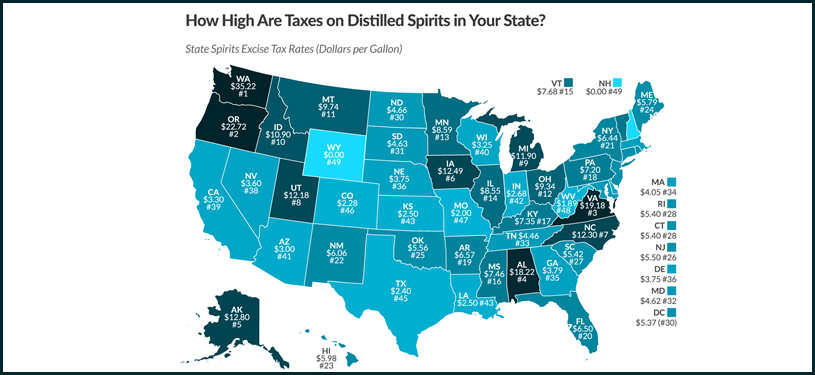

Vermont Liquor Tax 15th highest liquor tax. Beverage alcohol Manage beverage alcohol regulations and tax rules. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

The second is an excise tax which us 27 cents per gallon of beer and 55 cents per gallon of wine. Federal excise tax rates on various motor fuel products are as follows. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

Liquor sales are only permitted in state alcohol stores also called ABC Stores. Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. Sales Tax A sales tax of 6 is imposed on the retail sales of.

Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. We have provided a table to help guide you on page 2. Vermonts excise tax on Spirits is ranked 15 out of the 50 states.

Skip to main content. Vermont Business Magazine The Board of Directors of Brattleboro Memorial Hospital BMH announced today the appointment of Christopher J Dougherty as the organizations new president and chief executive officer effective May 9 2022He succeeds outgoing CEO Steven R Gordon who will retire in April and who has been at the forefront of. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states.

Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

New State Laws On Sexual Consent Health Care And Alcohol Sales Take Effect July 1 Vtdigger

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Sales Taxes In The United States Wikiwand

When Did Your State Adopt Its Sales Tax Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Whistlepig 15 Year Old Straight Rye Whiskey Finished In Vermont Oak 750 Ml Bottle

Vermont Income Tax Vt State Tax Calculator Community Tax

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Vermont Income Tax Vt State Tax Calculator Community Tax

Alcohol Taxes On Beer Wine Spirits Federal State

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Vermont Income Tax Vt State Tax Calculator Community Tax

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground